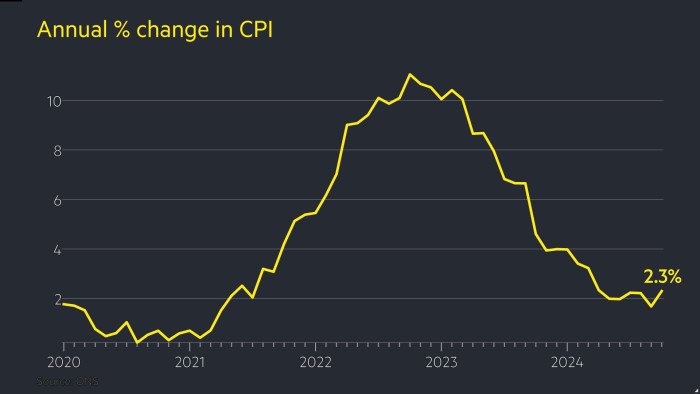

UK inflation accelerates sharply to 2.3% in October

Stay informed with free updates

Simply sign up to the UK inflation myFT Digest — delivered directly to your inbox.

UK inflation accelerated sharply to 2.3 per cent in October as energy prices rose, cementing traders’ expectations that the Bank of England will hold off cutting interest rates again until next year.

The annual consumer price index figure from the Office for National Statistics was up from 1.7 per cent in September and above the expectations of analysts surveyed by Reuters of 2.2 per cent.

Price pressures have been expected to rise after a 10 per cent increase last month in Britain’s energy price cap, which governs millions of households’ gas and electricity bills.

Core inflation was 3.3 per cent in October, higher than economists’ forecasts of 3.1 per cent, and up from 3.2 per cent in September, according to the ONS.

October’s figures complicate the BoE’s deliberations over when next to cut rates. The bank has repeatedly signalled it will pursue a “gradual” approach as it seeks to meet its 2 per cent inflation target.

Earlier this month, the BoE cut borrowing costs by a quarter-point to 4.75 per cent, but signalled that a further move was unlikely before 2025. The Monetary Policy Committee announces its next decision on interest rates on December 19.

Following the release of the figures, investors trimmed their bets on the chance of a cut at December’s meeting from 20 per cent to 15 per cent, according to levels implied in swaps market.

Analysts at Capital Economics said the data “lends some support to our view that the Bank will skip the December meeting and cut rates only gradually” beyond that.

The rate of services inflation, which is closely watched by the central bank as a gauge of underlying domestic price pressures, was 5 per cent in October, exceeding economists’ expectations of 4.9 per cent but in line with the BoE’s own forecast.

“These figures confirm a disappointing resurgence in inflation as the recent tailwind from lower energy costs turned into a headwind in October,” said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales. “Inflation should drift gradually higher from here.”

Alongside energy costs, the jump in the headline inflation was fuelled by higher prices across the transport, household goods and recreation and hotel sectors, according to the ONS.

On Tuesday, Andrew Bailey, the BoE governor, repeated the need for the central bank to adopt a cautious approach to further rate cuts as officials gauge the impact of chancellor Rachel Reeves’ Budget, which included a steep increase in employer national insurance contributions.

Several big employers, including J Sainsbury and Tesco, have warned of the financial hit from higher NI contributions, but the BoE has said the inflationary impact will depend on the extent to which companies pass the extra costs on to consumers.

“We know that families across Britain are still struggling with the cost of living,” said Darren Jones, chief secretary to the Treasury, in response to the figures. “That is why the Budget last month focused on fixing the foundation of our economy so we can deliver change.”

, #inflation #accelerates #sharply #October